Cannabis industry reality with Wall Street expectations

Added on 01 April 2020

As people become more educated as to the benefits of cannabis and more money pours into the sector, better predictive analytics can bridge the gap and help growers match investor expectations better.

Slow and ambiguous regulations coupled with stringent growing requirements have thrown a wrench into an already unpredictable farming model. But there are ways to smooth out future predictions. If you ever watched "Trading Places," you may note that yield and quality is anything but certain, even for generational farmers. Cannabis farmers are even more constrained as they do not have the option to farm GMO seeds. Most fertilizers and pesticides are forbidden on cannabis for safety reasons. This makes yields and quality even more unpredictable than traditional edible grown foods.

Predicting the future of your cannabis cultivation operation becomes all the more complex when new laws are regulated and developed by politicians who may or may not agree with helping the industry grow. Industry growth is hard enough without being tied to a very slowly developing regulatory framework of licensing. There are also large corporate lobbies that fear drug or alcohol sales may be disrupted, which would throw off their own predictable earnings, further slowing the governmental processes.

Growers can bridge the gap between what is currently offered and what investors are expecting through the following knowledge and tools.

Remember these key points and it will benefit your company's projections and analyses:

1. Know your market.

The U.S. market was the first to develop legally. State-by-state regulations have shown us which markets were truly pro-cannabis by setting up a good business environment, and which were mired in bureaucracy leading to very slow growth and expansion. When Canada opened up federal legality, there was a rush of investments expecting the world to change overnight. This market has since shown that governmental restrictions have slowed the sales channel's growth and large facilities are stock-piling products.

Then a lot of companies, including the Canadian LPs, touted Europe's 500+ million population as their savior for sales. Yet the regulatory framework does not exist there to support transportation and distribution, nor do proper laws allowing the sales of cannabis. Despite these setbacks in the states and Canada where investors were over-hyped by cannabis companies, the market is growing and is expected to continue.

2. Have a solid harvest schedule.

For cannabis cultivators, a harvest schedule can be anything from a simple spreadsheet to enterprise-level farming software. There have been many software developers entering and leaving the space over the years making software to help growers predict their future crop, and thus future cash flow. For most smaller growers, a simple spreadsheet that is tailored to how many spins your facility can generate will suffice.

Keeping a constant rotation moving through your grow will allow your future cash flows to become predictable well into the future. This does not ensure your product will be sold by the time it is ready. Some market guesswork as to demand is still needed to translate this to cash. However, going back to point one, in general, if the product tests well and is cured and trimmed well, there will always be a demand to buy that product.

3. Maintain compliance, cleanliness, and proper procedures.

The worst thing that can happen is if you predict your cycles well and then three months later, you get a failing lab report. This would be entirely your fault and preventable on top of it. 90 percent of the success of the harvest, dry, cure, and trim processes has to do with the ultra-clean environment, well-treated air, and super-tight procedures.

Protective clothes, gloves, and masks help avoid human-born contaminates, but airborne molds like aspergillus are always present and require cleaning protocols and air handling to prevent naturally occurring formations. This is a product that is often smoked or vaporized so fungus and molds are not acceptable.

An investor should be able to walk into your facility and see a clean environment and carefully thought out procedures before they invest. Research and development (R&D) tests on your plants throughout the entire grow, from harvest to dry/cure/trim process, will give you advanced warning to change your methods or procedures. There is a lot of new equipment out there to mitigate your crop safely if you spot a problem. If you wait until the end, surprises will be certain— and investors hate surprises.

4. Keep your budgets and books precise.

At any moment, an investor should be able to ask for proper reporting and bookkeeping. You must have at least twelve months of future predictions for your facility based on your harvest schedule and should be able to boast a 90 percent passing rate.

Sloppy numbers and missing your harvests are red flags to investors. Sure, sales may not occur on time, but at a minimum, you need consistently improving harvests, yield, quality, and passing rates. The sales will come and if properly cured. A few months of product backlog will be a comfort as opposed to the problem of no product to sell.

Assume the worst in your budgeting, time to sell, lower quality, and an even higher percentage of a failed crop. Never paint the most optimized results that can occur in a bubble; they never happen. As a rule of thumb, for the beginning double your costs, half your revenue numbers, and double all your major time events. This will get you close, but you will most likely still be off.

Growing is a fulfilling and humbling experience in the legal cannabis world, despite stringent testing and developing regulations. Sticking to your harvest schedule and having that translate properly to your future budgeting numbers is a must. Passing your product is critical. And getting your product on the shelf is the only way to keep your investors happy and believing in your future. Most investors believe in the future of the cannabis industry, but picking the right grower and company comes down to controls and the ability to bridge the gap of analytics.

Source: Green Entrepreneur

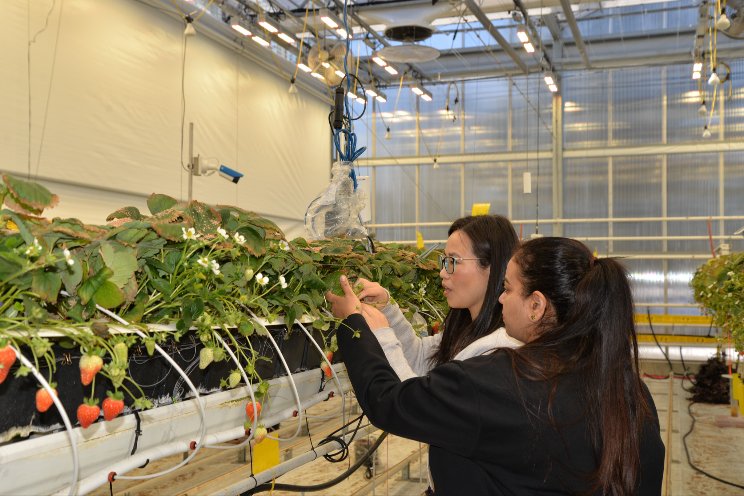

Photo by Chris Liverani on Unsplash

Source: Green Entrepreneurs

More news