Cannabis investing 4.20

Added on 01 April 2020

If you're watching the marijuana sector trying to anticipate your entry (or for early adopters, your exit), nobody can miss the carnage that the cannabis industry is experiencing. However, most investors can agree this will be a roughly $180 billion industry in the future and the industry is growing. So, rather than be depressed by the current negative readings, investors need to focus and make better choices.

The American market

The U.S. is the pioneer in modern-day cannabis legalization but is in danger of falling behind due to federal illegality. It still is the overall heavyweight in legal cannabis sales with more than $18 billion sold in 2019 and the most diverse array of manufactured cannabis products in the world.

State-by-state legalization and inter-state growth will continue as federal laws inch their way to getting much closer to changes. The U.S. is still ranked the most favorable market for cannabis consumption and investments, even though large investment companies, pensions, and fiduciary bound investment firms have yet to enter investing in the U.S. market.

The largest multi-state operator is CuraLeaf, and there are a few other large operators which will clearly be the significant players in the US. Large and mid-sized multi-state operators went on a tremendous buying spree through 2018 and part of 2019. However, there are still many private, as well as smaller public companies, that are showing significant growth and upside. At the low end of size, there are thousands of smaller independent grows which compete with the larger and mid-sized companies for their slice of the pie in each state.

The Canadian market

The Canadian market was only at $2 billion for 2019, with giants like Canopy and Aurora posting severe losses this past year and highlighting large debt risks. Companies like Tilray are suffering because the European market is still largely inoperable. Most large Canadian grows built relying on export models to EU and other continents/countries, as a large influx of money forced spending and they knew the actual Canadian market was limited. They took on tremendous amounts of institutional money and debts very fast and built gorgeous huge technologically advanced grows. But the EU still remains fairly anemic growth and even 2020 doesn't look so hot still.

Regardless, the sheer infrastructure of Canada is vastly superior for international commerce, while the U.S. markets remain largely closed to smaller sized grow that operate within State boundaries. Investors got burned by thinking markets like the EU and the US would just open up to imports, and the companies misjudged the speed of governmental adaptation of rules.

Canadian companies were also caught off guard as their own market went from months of undersupply to massive oversupply and stockpiling as large growing facilities came online. Limited medical sales in the EU of around 150 Million Euro didn't help either for 2019 as regulatory framework develops and most facilities in Canada and elsewhere are still getting GMP certified.

The European market

This leaves basically only the Netherlands as a current European supplier to Europe, who is still fixing their regulations and must build to go from a domestic supplier in order to reach the higher demands of the total EU markets. European grows are developing and coming online, like Tilray and smaller start-ups but the regulatory framework is still not ready for large scale distribution.

Germany has emerged as the first mass consumer with roughly 100 Million Euros in total sales and is expected to double by next year. Small pilot programs in Ireland, France, Italy, and Poland have developed but are catering to a small array of very serious health issues and largely avoiding chronic pain and other more commonly prescribed uses for cannabis. Countries like Denmark and Luxembourg have started limited recreational testing for internal consumption. Portugal and Greece have adopted legal frameworks for growing and exporting to other countries, but no real internal market for consumption.

By late 2021, a European framework for the growing and distribution of cannabis is expected to catch up to the corporations that which to enter. 2020 will be a year of announcements as more and more countries cautiously embrace medical cannabis sales but will remain anemic throughout the next two years. Infrastructure will start increasing as will demand which will largely be satisfied in the short term by non-EU exporters from Canada, the Netherlands, and Tilray of Portugal facility.

One of the more interesting models to come about in 2019 has been the export from countries in South America to Canada, and then Canada to the EU and Australia. This is an early adaptive innovation and may lead to further sales channels, in-roads and more approvals of genetics and products. However, the cost of transport far outweighs the infrastructure that will be created directly in the EU in the next coming years.

Specific avenues for investors to explore

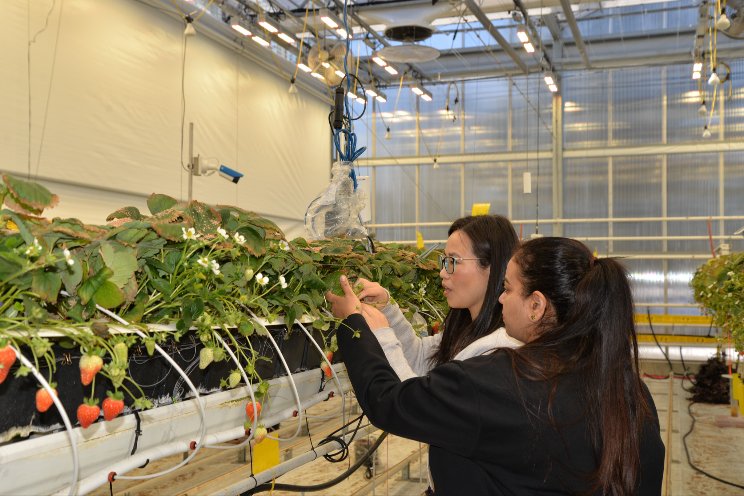

Supplying the industry has been a bright spot as the growth in companies requires servicing them. Brick and mortar sales like hydroponics and greenhouse suppliers are on the rise and profitable. Large supply companies like Kush Co have dominated everything from selling jars to bags and anything dispensaries or manufacturers need.

Sales and distribution will be clear winners as they are less capital intensive and more predictable than farming. And farmers need help navigating a multitude of complexities because only the largest companies have the capital to do everything. Even labs are great money makers despite the higher upfront costs of equipment and professional staffing. These entities supplying and helping the industry are currently profitable. And for anyone at Bizcon Las Vegas this year saw, the industry is growing around the world.

Profits in cultivation and manufacturing of cannabis have been elusive for 2019 as growing was the main thrust in the last few years. Besides government-driven delays, there are high taxes that have discouraged legal growth and encouraged the black market to increase in areas like California and Canada. And as decriminalization sweeps legal States and countries, there are fewer rules to prohibit black market growth further putting pressure on legal growing profits. This pressure will persist until costs come down low enough to make the black market too expensive and dangerous for consumers. We are already seeing the effects of the vape scares in profits, sales, and industry confidence.

Most markets actually aren't properly regulated making consumer safety a need to confront by governments. The rules need to not only be relaxed for growth but intensified to protect consumers. States and countries with the clearest rules are seeing the most growth because it gives investors and consumers confidence in the legal framework. These things are not at odds with one another. Consider the recreational industry versus the medical industry, where one is fairly lax and lacks education for the general consumer and one is too strict for something that a large majority currently uses.

Conclusion

Some of the winners in 2020 will be the larger to mid-sized companies that have profitable models that can attract capital and are showing organic growth. Private equity will be a winner in well-capitalized start-ups by experienced industry professionals that have learned tough lessons and are applying those lessons to a freshly capitalized company. Companies that understand how to navigate the legal pharmaceutical style sales style of most countries in the world will also emerge as winners.

Cannabis has drawn a lot of attention, but also a lot of bad management. Some say the money came too quickly for Canadian growers forcing them to spend fast before the markets were ready. Farming is an unpredictable model that even the best cannot always control. One thing is certain: this industry has a long way to go upwards.

Public company failures have led many to turn to private equity start-ups without the baggage. Whatever you choose, make sure you are well aware that this industry is young and there are many forces - from old perceptions to governments to large corporations - that don't want cannabis to succeed. But it doesn't matter because the train has left the station and consumers are demanding changes that will soon start driving decisions of governments.

Source: Business.com

Photo by Christina @ wocintechchat.com on Unsplash

Source: Business.com

More news