Vertical farming? Hope or hype?

Added on 10 November 2020

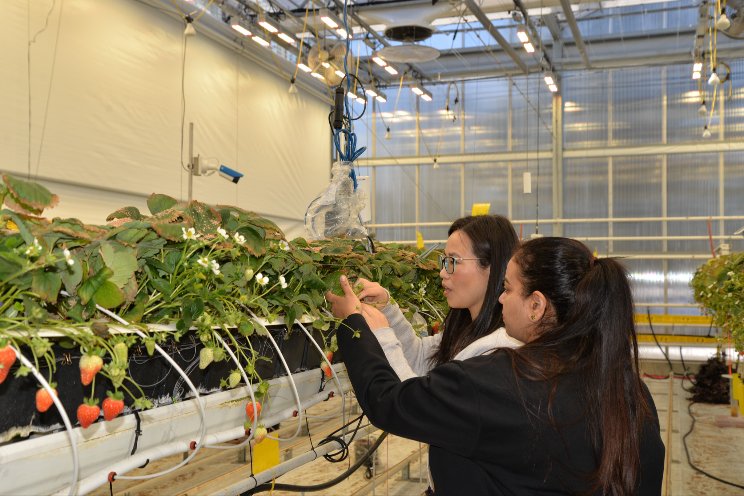

The nascent sector, in which crops are grown in stacked indoor systems under artificial light and without soil, has enjoyed a flurry of activity this year.

Headline-grabbing developments have included the construction of Europe's largest vertical farm, plans to build the world's biggest indoor farm in the Abu Dhabi desert, and a $140m fundraising round by a SoftBank-backed start-up Plenty. Norway's Kalera this week announced a $100m private placement ahead of its listing on the Oslo Stock Exchange's Merkur Market on October 28.

Proponents believe that the technology represents the future of agriculture, hailing huge efficiency and environmental gains for the food industry, and about $1.8bn has flowed into the sector since 2014, according to data group Dealroom. However, agritech entrepreneurs and analysts warn that hype and lofty promises could undermine the sector's credibility, putting off consumers and investors.

"There is a lot of BS coming from entrepreneurs," said David Farquhar, chief executive of Scotland-based technology provider Intelligent Growth Solutions. "There are far too many unsubstantiated claims about energy use, the environmental benefits and quality of crops."

High-cost, small-scale

The sector remains largely unprofitable and tiny. Vertical farming occupies the equivalent of 30 hectares of land worldwide, according to Rabobank analyst Cindy Rijswick, compared with outdoor cultivation of about 50m ha and 500,000 ha for greenhouses.

High initial capital investment and running costs mean it is hard to make a profit. Businesses must pay for specialised labour and face huge electricity bills for lighting and ventilation, while having to offer competitive prices to attract consumers.

Some operators in Japan are profitable while Nordic Harvest, the Danish start-up that has teamed up with Taiwan's YesHealth Group to build Europe's biggest vertical farm in Copenhagen, claims it will be profitable in its first year in 2021.

Keeping the faith

The industry is expected to grow over the next decade, with research group IDTechEx forecasting that annual sales of $700m will more than double to $1.5bn by 2030.

However, there is likely to be a cull of inefficient businesses in a sector that has always had a high level of failures.

"My big fear for this industry is that we will have some large failures," said Mr Farquhar. "It's not helpful for buyers' confidence, for customers' confidence and investors' confidence."

Vertical farming must also overcome perceptions among some consumers, often unfounded, that despite the various benefits it offers it cannot possibly match the taste of high-end produce grown with soil and sunlight.

Video: Can vertical farming feed cities of the future?

Tech challenge

Many vertical farms boast cutting-edge technology ranging from artificial intelligence and robotics to lighting and water filtration, and some companies, particularly in Asia, have established successful processes.

Stacked production systems allow the cultivation of produce in constrained spaces, including urban areas. That means food can be produced closer to its consumers, reducing transportation time and improving freshness at the point of sale.

But new entrants can face teething problems with automation and watering processes, leading to costs spiralling out of control.

There have also been cases of black mould and pest infestations hitting the farms, which typically do not use pesticides, according to Michael Dent, analyst at IDTechEx.

Image Courtesy of My Fintech

Taste test

Total control over the growing environment is one of vertical farming's big selling points, ensuring reliable, high-quality crops. A reduction in "food miles" gives consumers access to fresher produce, giving further taste gains.

Sceptics are possibly associating the sector's offerings with crops grown in greenhouses, which are often of low quality when growers prioritise yield over taste, according to Leo Marcelis, professor of crop production at Wageningen University in the Netherlands.

With many retailers only paying by volume, "growers think 'I don't get extra money for the quality' so they don't pay much attention to that", he said. Vertical farms may follow a similar path if and when they get to scale and price points of greenhouse rivals. However, for the moment, the sector's reputation lies in higher-value, better-tasting produce.

Salad days

Mr Dent believes boosterish claims that "we'll all be eating food made in vertical farms" are "a red herring and not helpful for the industry".

While most things can technically be grown in a vertical farm, production costs mean offerings tend to focus on higher-value leafy greens, salad leaves and herbs.

"Commodities like rice, corn and soyabeans — crops that are cheaply grown in the field and stored easily, I don't see as economic," said Prof Marcelis.

Vertical farming was not going to replace banana groves or fields of wheat, said Mr Farquhar, who added that IGS was trialling fruit and root vegetables as well as seedlings for R&D.

As Ms Rijswick puts it, vertical farming will only ever be "part of the mix among various growing systems".

Image sourced from Bloomberg

Source: My Fintech

Source: My Fintech

More news