Italian horticulture confirms record productions

Added on 15 July 2024

In 2023, national horticulture production maintained the record levels reached in 2022, with a production value of 3,143 billion euros. International exports are at the top: 'Made in Italy' accounts for 5.2% of plants and flowers exported worldwide.

According to data provided by Istat (National Institute of Statistics, June 2024), Italian horticulture production confirmed the sector's positive trend in 2023. The total production value of floriculture and nursery cultivation is 3,143 billion euros (4.7% of Italian agricultural production), in line with the record numbers of 2022 (3.14 billion euros). Floriculture appears to have settled at 1,465 billion euros (2.2% of Italian agricultural production).

Nursery productions have confirmed, according to Istat, 1,678 billion euros (2.5% of Italian agricultural production).

The trade balance of the sector remains positive, with an estimated surplus of 315 million euros to date.

This data is released by Myplant & Garden, the largest B2B fair for floriculture, gardening, landscaping, and sports greenery in Italy – among the most important internationally – scheduled at Fiera Milano Rho (IT) from February 19 to 21, 2025 (9th edition).

Export

According to initial estimates by international agencies, Italy confirms itself as the second European exporter and the third in the world with over 1.2 billion euros worth of plant products (production value), equal to 5.2% of global exports (stable compared to 2022), dominated by the Netherlands (48.2% of global exports, with a 1% decline in value compared to 2022) and followed by Colombia with 8.2% (almost 2 billion euros, a 2% decline compared to 2022).

After Italy with its 5.2%, Germany follows (4.1% of the total, an 8% decline compared to 2022) and Ecuador (3.9% of the total, a 7% decline compared to 2022).

“The stability of Italian exports is a very important and appreciable fact,” says Myplant, “in a context where many other major sector powers have shown declines and uncertainties in exports. Italian productions are recognized worldwide for their excellence, demonstrating resilience even in difficult times.”

In this special 'ranking', double-digit declines are currently evident for China (in tenth place with 2% of global exports, -11% compared to 2022), the USA (in eleventh place with 1.9% of global exports, -12% compared to 2022), and Denmark in twelfth place (1.7% of global exports, -14% compared to 2022).

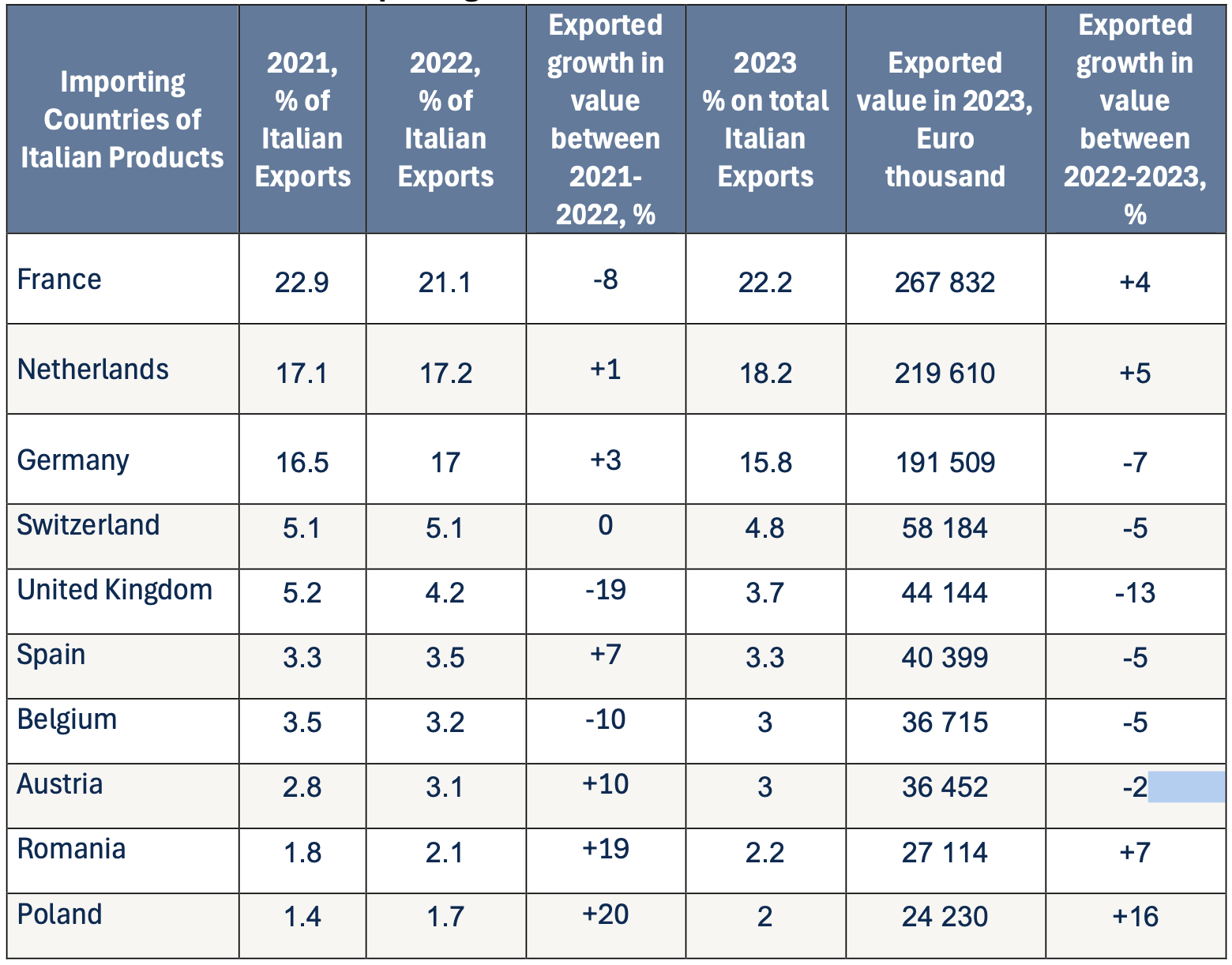

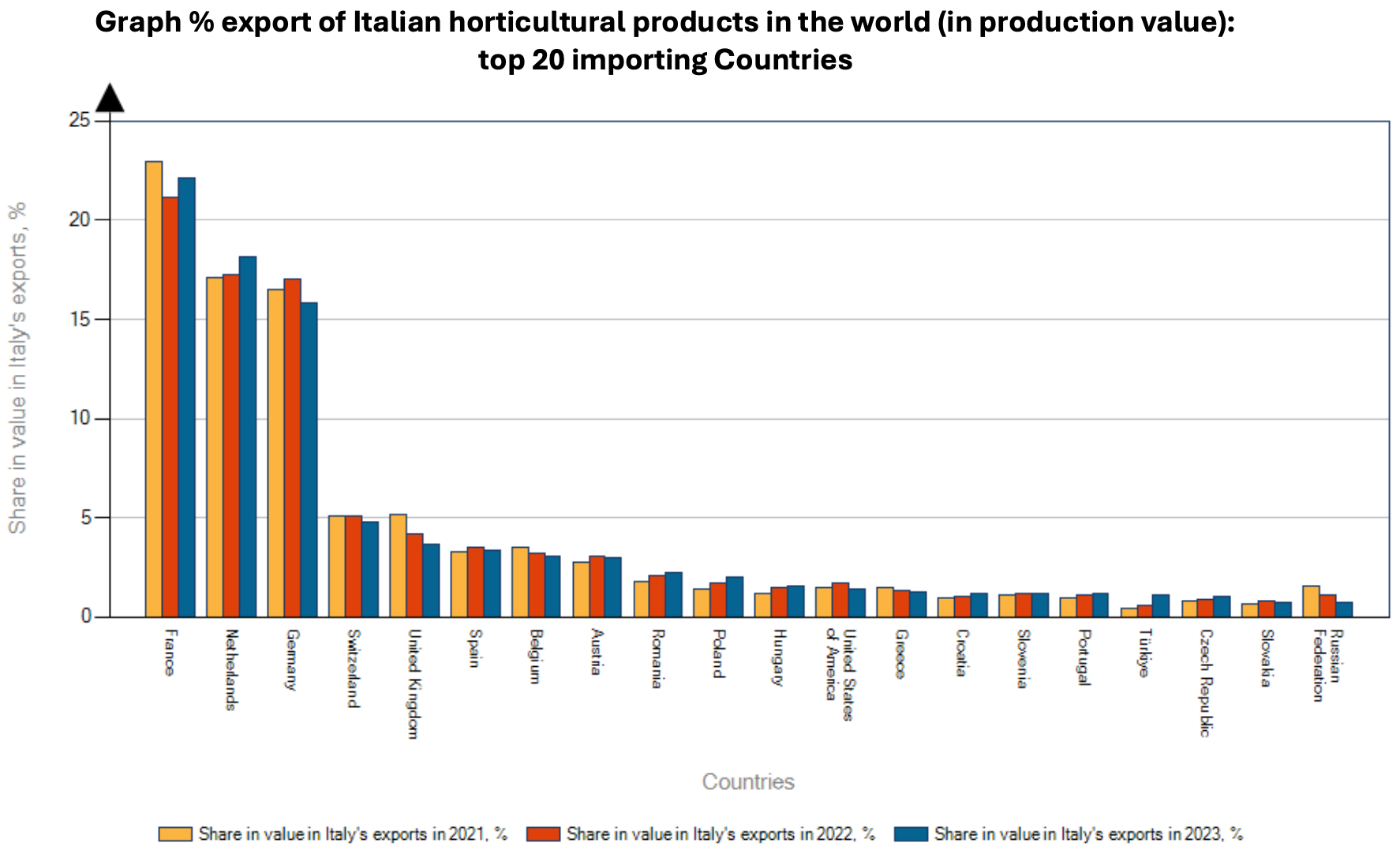

Most Italian products are exported to Europe.

The Old Continent is also the main supply market for Italy: the Netherlands is the main supplier of floriculture products (about 69% of total imports to Italy), followed by Spain (about 7.3%, up by 1 percentage point), France (5.2%, slightly up), Germany (4.6%, slightly down), and Poland (3.3%, up).

Despite still being marginal, the percentage increases in Italian exports to Croatia (+12%, exceeding 14.5 million euros) and Turkey (+75%, reaching 13 million euros) stand out.

The trade balance of the sector remains positive, with an estimated surplus of 315 million euros to date. Particularly positive for the Italian balance are exchanges with France (balance of approximately +220 million), Germany (approximately +150 million), Switzerland (approximately +58 million), and the United Kingdom (+44 million despite the decline in exports). The most negative balances for the Italian trade balance come from exchanges with Spain (-25 million) and the Netherlands (-400 million).

---

Solid signals come from domestic activities related to support and secondary services to the agricultural sector: +26.5% for land maintenance (including agricultural land, with 783 million euros against 619 million in 2022) and +20% for park and garden maintenance (408 million euros, 340 in 2022), “a theme we are very attached to and stimulate by organizing a series of events and B2B meetings between sector players and Public Administrations,” comment from Myplant.

The overall picture presented by the National Institute of Statistics highlights a challenging trend for the agricultural sector, with a production decline and a consequent drop in employment, mostly due to unfavorable weather conditions. These include severe hailstorms or late frosts, prolonged periods of intense heat, lack of precipitation, and, conversely, abundant rains. These conditions have made complex to plan productions and achieve satisfactory yields at the right time. “These are objective difficulties that have severely impacted and penalized other excellent Italian agricultural sectors,” say the organizers.

On the cost front for farmers in general, the Istat report highlights that in 2023, “the average price of goods and services used in agriculture decreased by 2.5%, after the sharp rise in 2022 (+30.6%).” Prices decreased significantly, especially for fertilizers (-18.4%) and energy products (-8.4%), while an average increase of 10% characterized the prices of intermediate consumables, primarily pesticides and seeds.

The last edition of Myplant (February 2024) concluded with 762 exhibitors (655 in 2023, +15%), 204 international buyer delegations (150 in 2023, +27%), 50,000 square meters of fair (45,000 in 2023, +10%), 25,000 attendees (23,000 in 2023, +8%), 114 accredited foreign purchasing brands (85 in 2023, +26%) from 45 countries and 4 continents.

Importing Countries of Italian Products

Graph % export of Italian horticultural products in the world (in production value): top 20 importing Countries

More news